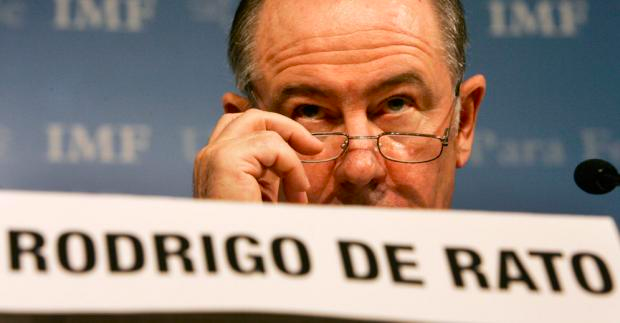

When the new IMF Managing Director (MD), the unfortunately named Rodrigo Rato, paid a visit to Buenos Aires last month he must have come prepared to lay down the law. Boy, was he in for a surprise! Rato set his own schedule for the visit, a fact that is somewhat remarkable considering he was requesting a meeting with the head of state of a sovereign nation. The hardworking president of Argentina, Néstor Kirchner agreed to meet but news of the meeting was leaked to the Argentine people and some unsavory anarchist elements were at hand burning tires in the streets while the two gentlemen held their discussions inside.

Mr. Kirchner inherited an economic system collapsed under a burden of a debt that was simply impossible to pay. He had little choice but to renegotiate the debt. In the IMF some believe that Mr. Kirchner may have got too sweet of a deal. Few expected that the Argentine economy would recover so well when they floated their currency and broke with the US dollar. Some creditors, mainly New York-based International Financial Institutions (IFIs), are anything but happy with the current deal and they want blood. Negotations are at a stalemate because you can’t get blood from a stone. Even the current terms of payment are unsustainable from an Argentine perspective.

One can only surmise that both Mr. Kirchner and Mr. Rato faced their first official IMF meeting with some dread. However few expected the exchange to be quite so combative. Mr. Kirchner must have been expecting a visit from the MD, Mr. Rato too had inherited problems from his predecessor and it was his job to solve them. As it turns out both gentlemen were experiencing opposite ends of the same problem. In the words of Mr. Rato when he spoke to Mr. Kirchner: “At the IMF we have a problem called Argentina”. Mr. Kirchner’s wry response: “I [too] have a problem called 15 million poor people.”

If Argentina has been a thorn in the side of the mighty IMF then the IMF and the foreign investment banks that it represents is a tremendous splinter in the side of the Argentine people. The negotiations between these two powerful entities have been watched closely by many over the past 5 years for they question the very validity of the IMF. If Argentina falls then so many others may too; Brazil, Argentina’s neighbor and partner and co-founder of MERCOSUR, might not be far behind.This duel has very high stakes, and one has to believe that the fight shall be to the death. Neither side can afford to lose. Kirchner’s political future and the Argentine people’s economic livelihood depend on a fair and equitable solution to the unenviable debt burden. But there are two sides to every loan. The Argentine government owes money to both individuals and IFI’s worldwide and everyone wants first bite of the cake. The problem of course is that you cannot run a country, especially a complex and large country like Argentina, with debt service costs approaching 10% of GDP. Something has got to give! Like creditors at a bankruptcy sale, everyone is lining up for a pay-off but there is not much to offer.One could argue that the challenge presented by the enormity of the Argentine problem combined with the reality of default has turned over the power to the negotiating teams of the Argentine government in a way that is alien to the ever-powerful IMF. Trained as economic hit men , IMF employees have extraordinary power to advise debtor nations. The purpose of this advice is arguably to maximize the possibility of debt repayment but the truth is that the advice rarely stops there. IMF advisors are the self appointed vanguard of the neo-liberal dream (whether the country under advice has chosen the neo-liberal path or not).

Suffering onerous debt? No problem! Increase taxes, cut social spending, peg your currency to the dollar that you can repay the debt, sell off some national jewels (often not to the highest bidders but to favored corporations) and hey presto! You can afford those precious repayments; for this year at least!

The IMF advisors are used to getting their own way and Argentina has historically been known to do their bidding. The government even capitulated when required by the IMF, and its sister organization the World Bank, to privatize Argentina’s Social Security system. This suggestion which might even make Mr. Bush blush, has proven financially disastrous. Sometimes the toll of following IMF advice is a downward spiral of higher payments, less competitive exports and human misery. Such has been the case with Argentina and the Argentine government has taken the unusual step of publishing an official document detailing the consequences of following the erroneous advice offered to them by IMF advisors and their direct relationship to the current Argentine crisis.

Traditional economic theory states that developing countries need funds to develop. By borrowing those funds from other countries they can accelerate development and thereby kick-start growth. The IMF has been set up as an organization whose aim, in conjunction with its sister organization, the World Bank, is nominally to help eliminate poverty by facilitating an international line of credit to developing countries who need it. The carrot offered by the IMF is the availability of credit, the stick is its lack of availability. The IMF makes judgments based largely on repayment histories and political pressures from lender countries. If they don’t think you are playing by the rules then they simply turn off the tap. Their negotiators have traditionally been in the driving seat with teams moving from debtor country to debtor country literally back-seat-driving the world’s developing economies. At least this has been the case to date.

A little publicized Agence France Press (AFP) wire story was picked up Wednesday 10th Nov. by very few outlets. I happened to catch it on column five of page thirteen the Peruvian Daily, La República. It seems rebel economist Paul Krugman, of New York Times fame, was speaking from the US via videoconference to the 52nd Annual conference of the Argentine Construction Federation when he uttered the unutterable. He claimed that Argentina did not need the help of the IMF to attract investment. Referring to the sizeable growth in the economy in recent years he suggested that investment would be forthcoming from IFI’s regardless of what the IMF had to say.

As if to prove the point the October 20th piece argues convincingly that Argentina is in a very strong position in its negotiations with the IMF. He argues that the threat of “…interruption of access to international credit markets” is null and void because, “Argentina has not had access to these markets since 2001 and has still managed to emerge from the crisis.” A country with a surplus can fund its own development and is less beholding to international credit markets and rating agencies.

The current state of play is a curious stand-off where Argentina have unilaterally suspended their January 16th letter of intent yet continue to pay large chunks of cash to the IMF. It remains to be seen how Argentina will renegotiate its new relationship with the IMF in the New Year. The official word from the IMF is: “that completion of a comprehensive and sustainable debt restructuring agreement with private creditors is critical for Argentina’s economic prospects.” Many economist are starting to question that logic.

The question for now is whether it is the IMF negotiators or the Argentine government who should worry as they digest their Christmas dinners.

Leave a Reply