Americas Program Special Report, By Tony Phillips

Originally at cipamericas.org http://www.cipamericas.org/archives/1434

Español traducido : Argentina versus el Banco Mundial: ¿Juego limpio o partido arreglado?

Traducido por: Annette Ramos

Americas Program, Center for International Policy (CIP)

| Perspectives on the ICSID and Argentina’s Debt “Some multinational companies take over our natural resources, privatize basic services, fail to pay taxes and then, when they have no arguments in their defense, they go to the so-called ICSID. And then, in that World Bank tribunal, no country wins against the multinationals. So why do we need an ICSID where only the multinational companies can win?” President Evo Morales of Bolivia Hardly one of the world’s poorest countries, Argentina is a self-confident Latin powerhouse with a booming economy. Its heated struggle with the vultures is being watched by investors around the world. The outcome will reverberate in global capital and financial markets and influence the behavior of dozens of other governments. Debt forgiveness may have captured the imagination of Hollywood activists, but debt collecting is still a critical part of how the world’s financial system works, and Argentina is putting that part of the system to the test. David Bosco,[1] “The Debt Frenzy; Vulture Funds,” Foreign Policy, July 1, 2007 “This is a threat to the entire international system of lending to developing countries. It’s a threat to the flows of business investment to developing countries, and, it is very important that the United States and the European Union say to Argentina: “No! You cannot behave differently to every other country which defaults and expect to enjoy access to our capital markets, [and] expect to enjoy any special trade concessions as they do in the United States under the General System of Preferences. You must play by the rules as a responsible member of the Global Economy.” Robert Schapiro, Former Clinton Administration Undersecretary for Commerce,[2] Chairman Sonecon LLC (2016) |

On Feb. 4, 2008, news came over the wires from Rome that the World Bank had appointed Robert Briner to head up an arbitration tribunal to decide yet another claim against the Argentine government, this time by Italian corporate lawyers. The arbitration will take place in the Washington, DC-based “International Centre for Settlement of Investment Disputes” (ICSID), an obscure World Bank arbitration forum.[3] Obscure that is,outside of Latin America. While mention of the ICSID in London or New York will likely elicit confused stares, in La Paz or Buenos Aires it could well provoke a string of expletives.

Argentina is the ICSID’s biggest caseload and the ICSID represents a significant agent in the Argentine economy. A single negative ICSID ruling could cost the Argentine public hundreds or thousands of millions of dollars, equivalent to a significant tax loss or the price of constructing many, much needed, new hospitals. The ICSID has cost Argentina more than a billion dollars to date, and this latest ICSID claim from Rome is for a cool $4.4 billion, nearly a tenth of Argentina’s national reserves.

“Task Force Argentina” and the Italian Litigants

The Italian legal consortium refers to itself as “Task Force Argentina” (TFA).[4] Headed up by the Italian corporate law firm Grimaldi & Associates, Task Force Argentina has legal partners in Washington and Buenos Aires. Their clients are called hold outs because they are owners of defaulted Argentine bonds who rejected the renegotiation terms offered in 2004 by then-Minister for the Economy Roberto Lavagna.

The TFA represents funds with a legal presence in Italy that holds Argentine sovereign bonds. These funds purchased Argentine national debt, a risky investment but with high returns. Whether bonds were bought in the primary market at face value or as junk defaulted bonds at a steep discount after the default, they are still treated as hold outs.

The Argentine Financial Crisis

When Argentina defaulted in 2002, its bonds lay in limbo. Lavagna, a professional economist (now turned politician and presidential candidate in 2007) was chosen by former President Nestor Kirchner in 2004 to broker a deal on payment of the bonds. His task was to clean up after the largest national default in history. At the time, the Argentine government’s coffers were bare, and both the people and the government were convinced that speculative investment tools were at least partly responsible for their predicament. Lavagna offered[5] bondholders a deal that paid about a third of the face value of the bonds,[6] and conversion to new bonds at very attractive interest rates. Most bondholders accepted, however some, including the Italians, decided to hold out for a better offer.

In bond markets defaulted sovereign bonds are referred to as “distressed debt”; rather like shares of bankrupt companies, they are worth little or nothing. Distressed debt leads to secondary consolidation, when vulture funds buy up these defaulted bonds on the cheap. Vulture capital firms make a business of buying distressed sovereign bonds until they have enough to make it worth their while to pay the corporate lawyers to take the issuing country (Argentina, in this case) to court. Such litigation for Argentine distressed debt has happened many times in the past, such as the (appealed) win by NML/Elliott & Associates, New York, 2006.[7]

Vulture capital funds are more than a play on the more familiar term “venture capital funds.” These funds feed on financial instruments left for dead.

They are the repo-men[8] of the international sovereign bond market, but they don’t repossess property of the original investor—they collect for themselves. While a real repo-man may break into the vehicle of an owner who has fallen behind in payments and drive it back to the seller’s parking lot, vulture funds have been known to try tactics such as putting a lien on Argentina’s publicly owned national dollar reserves held with the U.S. Treasury.[9] If successful, such tactics can lead to shortages of funds for social programs.

Vulture funds purchase the distressed debt of poor countries for cents on the dollar then hire international law firms (and lobbyists) to press for full face value plus interest. They make a business of punishing economies in recovery. The Italian TFA are doing just that in the ICSID case—pushing for the full face value of the “tango” bonds, with interest.

With the announcement from Washington appointing Briner the president of the TFA in Rome, Nicola Stock was ebullient. He expressed great satisfaction at overcoming obstructions he said were put in place by the Argentine defense lawyers to block the suit from getting to the ICSID

The Argentine Caseload with the ICSID

The Argentine Attorney General, Esteban Righi, receives ICSID notifications of pending cases. He’s extremely busy these days. Argentina currently has 34 cases pending in the ICSID and others already concluded. Argentina accounts for more than one-quarter of the world’s total pending ICSID caseload.

To put this in perspective, there are 155 states that are members of the ICSID. There are currently 123 pending cases. More than one half of these are pending against Latin American governments. Brazil (Latin America’s largest economy), faces no litigation in the ICSID, it can’t—it chose not to become a member of the ICSID. Brazil has signed many bilateral agreements on investment but its legislature never ratifies them. It is thus immune to the ICSID. Despite this Brazil has had few problems attracting foreign direct investment (FDI). Bilateral Investment Treaties (BITs) are designed to protect foreign investors; the theory is that by signing a BIT, developing countries promote FDI. The Italian litigants argue that the Argentina-Italy BIT (signed May 22, 1990) protects Italian holders of defaulted Argentine bonds.

OECD “Investment” and Developing World “Investment

Latin America’s caseload of 63 outstanding ICSID cases dwarfs the claims against countries of the Organization for Economic Cooperation and Development (OECD), the world’s leading receiver of FDI. Most OECD countries are members of the ICSID, however they face a total of just eleven pending cases (four against Mexico, four against Turkey, one against Canada,[10] the Czech Republic, and the Republic of Slovenia). None of the original fifteen member states of the European Union have pending cases[11] against them, nor does the United States.

The OECD is an invitation-only member’s club. On the other hand, membership of the ICSID is actively encouraged, and in some cases required, by the World Bank (WB) and International Monetary Fund (IMF) loan and bail-out conditions.

Internal discussions about FDI into OECD countries relate to investments in the OECD countries themselves. OECD members speak of protecting members from investments in key “strategic sectors.” There is a tacit recognition for the need for limited protectionist measures in sensitive sectors such as security, energy, and investments within their borders by Sovereign Wealth Funds (SWFs). Some of these issues are even included as exceptional clauses in Bilateral Investment Treaties (BITs). Recent examples include the decision by the United States to block Arab Gulf and Asian investments in U.S. port handling facilities and in the U.S. oil sector.[12] In contrast, OECD discussions of outward investment are replete with terminology like ” freedom of investment” and the need to tear down protective barriers.

What Exactly is the ICSID?

This first set of tables below analyzes the range of cases by region, country, and industry sector. The second section is an analysis of the Argentine caseload related to recent Argentine economic history and the bilateral investment agreements signed by Argentina in the 1990s.[13]

A review of the types of cases being brought before the World Bank’s ICSID—which companies are bringing them, and for what kinds of “investments,” and also the countries facing such litigation—illustrates the workings of the Center. The following tables point out the diversity of ICSID cases pending in February 2008.

Tables 1, 2, and 3: Sub-dividing Cases by Region

| Who is claiming against whom? | Number of cases |

| Corporations/Individuals suing states and state agencies | 122 |

| States suing Corporations | 1 |

| World By Region | Number of cases |

| Latin America | 63 |

| Former USSR Republics | 23 |

| Asia including the Middle East region (not former USSR states) | 14 |

| Africa | 14 |

| Others (of which Turkey has 4 cases) | 9 |

| Latin American Countries ranking by country | Number of cases |

| Argentina | 34 |

| Ecuador | 7 |

| Venezuela | 5 |

| Mexico | 4 |

| Peru | 3 |

| Paraguay, Bolivia, Costa Rica | 2 (each) |

| Honduras, Guatemala, Panama, Grenada | 1 (each) |

The situation currently faced by Argentina, Latin America, and most of the developing world represents an entirely new and somewhat perverse shift in power. What is new is that (mostly poor) sovereign nations now find themselves forced to defend themselves against lawsuits by foreign corporations before unaccountable and biased business courts. The ICSID lacks transparency and accountability because it operates in secret and has no basic mechanisms of control (e.g. appeals). It is biased because it depends on appointments by business. The businesses invariably choose appointees favorable to their interests.

By signing BITs, developing governments cede sovereignty. Through BITs, Bilateral Trade Treaties (BTTs), and the ICSID, multinational corporations now wield litigation powers once reserved for states. In the ICSID multinational corporations can sue the state directly, something even beyond the powers of the WTO.

Why Bilateral Investment Treaties?

A BTT governs trade of goods between two countries. [14] Some BTTs have clauses that relate to international investments too. Investments are not goods; they are treated as a special kind of “service” (financial services). BTTs and BITs are signed between two countries to provide protection for international investments.

BITs and the ICSID are a new concept reflecting a global power shift, not from a closed economy to a globalized “modern” state (as promoters assert), but to globalized transnational corporations. Corporate influence in investing countries has always been influential in diplomatic and even military circles, but the ICSID takes this influence one big step further.

BITs signed between developed and developing countries are written to protect the developed corporation’s investments in the developing countries. Bilateral means two-way, meaning such treaties theoretically protect investments made by firms in either direction. The problem is that investments by developing countries in OECD countries rarely happen; most flows of investment go from developed to developing countries, so investors in the developed countries actually benefit from that bilateral protection. In return, the developing countries accept investment treaty clauses that imply ceding national jurisdiction in the case of an investor claim.

Should an investment litigation result, a BIT can specify the jurisdiction in which commercial litigation can take place. BITs written by investing countries encourage foreign jurisdiction where they have more influence and a relative advantage. The ICSID represents not only a change of jurisdiction but an entirely new type of litigation. Membership in the WTO, for example, involves ceding jurisdiction to an external legal forum for nation-to-nation litigation.[15] The ICSID goes one step further, ceding national jurisdiction over disputes relating to FDI within state borders (even in sensitive industries and resources) by enabling the state to be sued by an investing corporation directly using laws defined outside of its territory. The court that decides the claim (the ICSID for example) is therefore outside of the country in which the investment is made.

The mainstream economic argument most prevalent in the neoliberal 1990s cited the need for foreign investment in developing countries as reason enough to sign bilateral treaties even though those treaties are written in pro-investor interest. But if BITs are really more unilateral than bilateral, why would a developing country sign such a treaty? The fact is that some do not. Moreover, many of those that have not ratified bilaterals, like Brazil, are major beneficiaries of Foreign Direct Investment.

In the commercial sector the argument is that investment brings jobs, technology, and much needed hard currency into investment-starved developing countries to foster economic growth. The fact is that although many richer individuals in developing nations may have relatively high savings rates, they are often loath to leave their savings denominated in their own (often intentionally) weakened currencies for fear of further devaluation. Many also have an aversion to paying taxes. This leads to the flight of savings of these rich elites abroad.[16] Money invested in other countries’ currencies and banking systems leads to a domestic shortage of credit. To make up for these limitations and foster growth, “green field” (new productive investment) and long term FDI are considered crucial, and to attract such investment signing a bilateral is the prescribed course of action.

While it is reasonable, and arguably necessary, to encourage flows of capital (and at least theoretical) technology transfer from industry in developed economies, the kind of investment attracted is important. Using a BIT as the basis for vulture capital litigation is not the same as using it for litigating failure to pay for a necessary infrastructure project such as a train service or an airport. They are different “investments.” This latest Argentine test case will help determine whether BITs will apply the same criteria to both kinds of investors, commercial and speculative financial.

1990s Argentina, The Miracle of Menem

In the early 90s, during the Carlos Menem presidency (1989-1999) Argentina signed many BITs or upgraded extant bilaterals. It is easier to convince a cash-starved trading partner of the value of a BIT, especially if the trading partner is deeply in debt and highly dependent on FDI. It is easier still if the partner’s government is rife with corruption.

In the 1990s Argentina reached the zenith of its privatization phase, planned since the 1976 military coup by the Junta’s financial architect and minister for economics, Jose Martinez de Hoz. The privatizations were presided over by the IMF and the Menem government. During Menem’s presidential terms, Argentine debt hit critical and unpayable levels and the IMF said that privatization was a way out—it was not. The country held a fire sale of its national industries. Many warned this would never last but there were willing investors, especially from Europe. The terms of BITs and the ICSID process seemed to guarantee their investments.

Around 90% of all nationally-owned assets were privatized and sold off to mainly European and U.S. companies. These included Argentina’s national oil and gas company (YPF), the prize jewel in the crown, sold to Spain’s oil multinational Repsol. Menem also privatized water services, telecommunications (including the television spectrum), national highways, and the national postal service.

The artificially high dollar peg of the Argentine peso had various effects: it made the local Argentine market attractive for investors from abroad selling services within Argentina. On the other hand, it should have made the privatized firms in Argentina expensive as they were priced in overvalued pesos. In reality prices were reduced due to high country risk, debt-for-shares transactions, and lack of competition due to corruption.

During the 90s the high peso also had very negative effects on exporting Argentine companies who found their goods and services difficult to sell abroad and at the same time found it difficult to compete with cheaper imports.

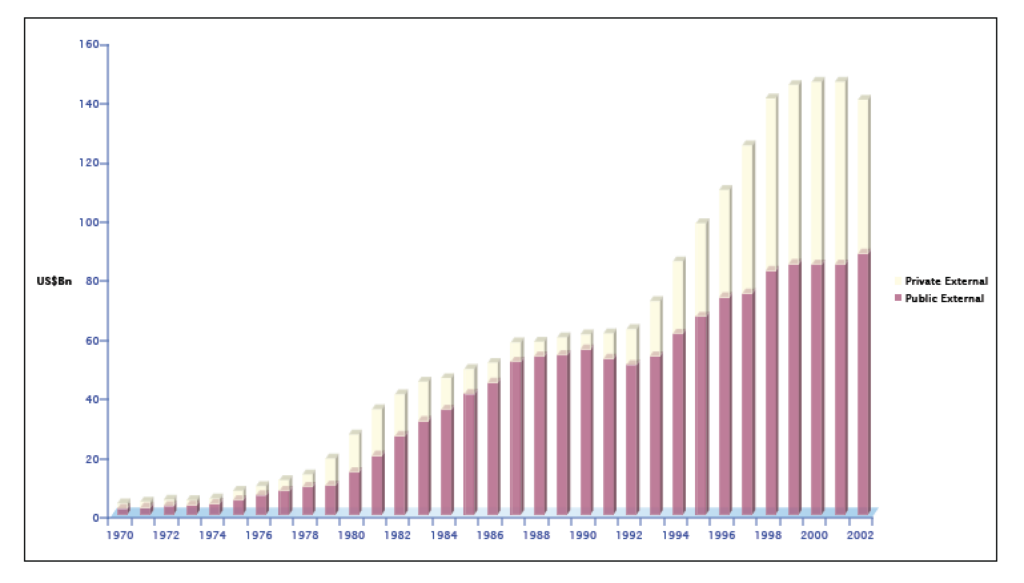

Rising imports (fomented by lowering import duties during Menem’s term) worsened the economic position of the Argentine economy, increasing deficits and foreign debt. Public and private debt became a vicious circle (see Figure 1) leading inevitably to the crisis and the default in January 2002.

Figure 1: Argentine Sovereign and Private Intl. Debt 1970 to 2002

In an attempt to improve Argentina’s image and to compete for investment from abroad, the Argentine government signed or renewed a number of bilateral trade agreements and BITs with key trading and investment partners including the United States (various in the 1990s including specific agreements guaranteeing investments), Germany in 1995, Spain in 1998, Italy in 1999, etc. Most important, President Menem signed Argentina on as a member of the ICSID in 1991. ICSID arbitration was mandated in some bilateral agreements and in some privatization contracts.

The die was cast.

Argentine bilateral treaties signed during first two years of President Menem’s first term:

| Country | Signature Date |

| Italy | May 22, 1990 |

| Belgium-Luxembourg | June 28, 1990 |

| United Kingdom | Dec. 11, 1990 |

| Germany | April 9, 1991 |

| Switzerland | April 12, 1991 |

| France | July 3, 1991 |

| Poland | July 31, 1991 |

| Chile | Aug. 2, 1991 |

| Spain | Oct. 3, 1991 |

| Canada | Nov. 5, 1991 |

| United States of America | Nov. 14, 1991 |

| Sweden | Nov. 22, 1991 |

Signing the BITs and joining the ICSID opened up Argentina to the barrage of litigation it now faces. Many lawsuits are the result of foreign investors litigating for dollarized income from their investments while the rest of the economic system has been peso-ized at a rate of 3.2 pesos to one US dollar. Local industry faces a similar devaluation of their assets but have no recourse to the ICSID. It can be argued that this gives foreign multinationals an unfair competitive advantage in the Argentine market.

The Argentine Debt Crisis

The Argentine tragedy is infamous in the annals of international debt. Argentine sovereign debt was extremely low the middle of the 70s but was increased 480% between 1976-1983 under the economic leadership of the Junta’s Finance Minister[17] Martinez de Hoz and his successors.

Martinez de Hoz came to power espousing a classic neoliberal economic plan. He suggested that the economy should be opened up to FDI, liberating capital flows, and that the state should take a secondary role, trusting the economy to the market. He promoted privatization of state industries from day one, using the classic theoretical assertion that private companies are less corrupt and inherently more efficient. In the memoirs of his ministry for economics, he paraphrased his model using the prevailing jargon:

“… along with the subsidiary status of the actions of the state, the other basic pillar upon which [I] base [my] economic program is the opening up of the economy. As such it becomes necessary to bring about the maximum liberty possible for foreign commercial transactions in goods and services and for the movement of capital.”[18]

As happened in Chile after Pinochet, in the early 1980s Argentina experienced an incomplete return to democracy after the disastrous war with the United Kingdom; however there was little change in economic policy. The rest of the 1980s were bad for Argentina not just in terms of debt growth but in terms of economic growth. This was the case with most of South America but particularly those states front-loaded with foreign debt in hard currencies. The 80s were known in South America as the “lost decade” as debt rose with high global interest rates and sluggish or negative economic growth.

Figure 1 shows that there was a short respite (1990-1993) from debt growth during the early part of Menem’s first term, mainly due to privatization.[19] In 1994 the economy and the debt took a severe turn for the worse and debt continued to grow at an alarming rate. It couldn’t last, and it didn’t. Debt levels forced a default in the so-called crisis of 2001-2002. Never before was so much money defaulted by one country in one fell swoop. Favoring half of their creditors (including ISI’s) Argentina defaulted on the other half of its public external debt, about $82Bn in face value. The size of the default is even more extraordinary when compared with the national product of Argentina or its population of less than 40 million people.

High Country Risk Proves Warranted

Within two years of the end of Menem’s term, economic chaos reigned in Argentina. Between Dec. 10, 1999 and May 25, 2003 there were five acting heads of government. Not one completed his term. The government entered into default during the eight-day tenure of Adolfo Rodriguez Saa. The parity mechanism failed, and the peso broke with the dollar. The banking system failed, and poverty and indigence increased to levels never before seen. In short, Argentina faced societal and economic meltdown. The period is generally referred to as “The Crisis.”

There was vast flight of capital from the liberalized economy. But non-liquid capital invested in privatized firms had no choice but to endure the crisis, endure that is until Argentina accumulated enough international reserves to be sued for “damages” in the ICSID.

The Argentine crisis isn’t over yet. However Argentina is in recovery and the foreign corporations that can claim “losses” related to “expected gains” (due to price controls or the lower value of the peso) are litigating to make good their so-called “losses” in the ICSID.

The Default

Bondholders holding about half of Argentina’s foreign debt were forced to take a haircut on the value of their bonds. A “haircut” is a financial term for a loss in face value on bonds (rated as “junk” or below). The haircut is offered to the bond owners by the bond issuer for their bonds in default. Haircuts are common occurrences in bonds that are a speculative investment with high risk and high return. Sovereign bonds have defaulted before but the Argentine haircut was unprecedented in both scale and in percentage terms. No one invests in Argentine bonds for the stability of their investment.

Lavagna, President Kirchner’s minister for economics at the time, engineered the offer referred to as the “Argentine default.” In Argentina this is called the “mega canje” or “mega exchange.” The haircut offered by Lavagna reflected the severity of the debt crisis. About 60% of the bond owners accepted Lavagna’s offer of 30% of face value of the bonds as better than nothing. The rest held out or sold their distressed bonds to vulture funds.

When vulture funds sue sovereign governments for their “investments” they are seeking enormous compensation for what were in fact other people’s losses. In the infamous Dart Family vulture fund case (litigated in New York and not in the ICSID) a demand of approximately US$750 Million was made against Argentina. It was first granted then successfully appealed. Hundreds of similar lawsuits are currently underway outside of the ICSID and Argentine courts (many in New York).

Who is Suing Argentina and Why?

Global corporations have lobbied successfully to build a worldwide infrastructure to protect their interests. The World Bank, International Monetary Fund, and other international financial institutions have broken down barriers to international corporate activities in most countries on the planet by imposing policy conditions on their lending.

These reforms have typically included privatization of state-owned enterprises and services, trade and investment liberalization, and other reforms aimed at creating “investment friendly” environments. Through an explosion of multilateral and bilateral trade and investment agreements, global firms have acquired new protections against government acts that might reduce their profits. And to enforce these new privileges, they can turn to an arbitration body connected to the World Bank, the International Centre for the Settlement of Investment Disputes, and other similar international tribunals.[20]

The following table breaks down the pending suits against the Argentine Government by sector, listing the names of the companies that are claimants. Many of the corporations litigating in the ICSID are the same firms allocated privatized public-service contracts by Menem’s government.

| Sector | Claimant Companies |

| Oil, Gas, or Energy (13) | AES Corporation & Camuzzi International S.A. & Gas Natural SDG, S.A. & Pan American Energy LLC and BP Argentina Exploration Company & El Paso Energy International Company & Enersis S.A. and others & Electricidad Argentina S.A. and EDF International S.A. & EDF International S.A., SAUR International S.A. and Léon Participaciones Argentinas S.A. & Mobil Exploration and Development Inc. Suc. Argentina and Mobil Argentina S.A. & Total S.A. & BP America Production Company and others & LG&E Energy Corp., LG&E Capital Corp. and LG&E International Inc. & Compañía General de Electricidad S.A. and CGE Argentina S.A. |

| Water or Sewer Services (9) | Suez, Sociedad General de Aguas de Barcelona S.A. and Interagua Servicios Integrales de Agua S.A & Suez, Sociedad General de Aguas de Barcelona S.A. and Vivendi Universal S.A & Azurix Corp. (water division of Enron corporation) & SAUR International & Compañía de Aguas del Aconquija S.A. and Vivendi Universal & Urbaser S.A. and Consorcio de Aguas Bilbao Biskaia, Bilbao Biskaia Ur Partzuergoa & Impregilo S.p.A. & Giovanni Alemanni and others & Azurix Corp. (second suit) |

| Highway Construction (2) | Wintershall Aktiengesellschaft & HOCHTIEF Aktiengesellschaft |

| Telecommunications (2) | TSA Spectrum de Argentina, S.A. & Telefónica S.A |

| Information Services (2) | Siemens A.G. & Unisys Corporation |

| Debt instruments (3) | Giovanna a Beccara and others, Giovanni Alemanni and others and Asset Recovery Trust S.A. |

| Motor vehicles (1) | Metalpar S.A. and Buen Aire S.A. |

| Insurance (1) | Continental Casualty Company |

| Leasing (1) | CIT Group Inc. |

Legal and Commercial Arguments

It is clear that legal protection of “investments” is a positive measure for the investor and, potentially, also for the state in which the investment is made. In the case of foreign debt (foreign ownership of sovereign bonds) the problem of resolving defaults goes beyond the issue of jurisdiction of the claim, or the legitimacy of a debt. The problem itself is a difficult one and it is complicated by the fact that the owners of the bonds often reside in different jurisdictions.[21]

The state cannot unilaterally restructure its debt without significant damage to its financial reputation, therefore it needs to try to renegotiate as Argentina did. However this implies that the restructuring plan be accepted by the various owners of the bonds, which is difficult to coordinate and leads, typically, to a division of the groups into those who accept the offer and the hold outs.

Investors are attracted to emerging market debt because of the returns that it offers as a risk premium. If the risk is assuaged by a litigation-friendly system that enables (even encourages) vulture activity, then the legal system is clearly distorting the risk and is at odds with the needs of both the bond-holders and the sovereign state (to agree on a bailout). Hold outs typically hold out for 100% of the face value of the debt (plus interest) which puts their interests at odds with any restructuring[22] effort.

Finally there are the issues of taxpayers’ interests sometimes being at odds with private interests whether because taxpayers eventually fund the payment of sovereign debt or because they fund multilateral organizations (such as the IMF or the WB) which may take losses either trying to prevent the restructuring or helping to recover from it.

Sovereignty Issues

Investment from abroad is an investment in a country with all the ensuing risks and legal jurisdiction issues that this entails. Whether FDI leads to green field (new) production or the FDI is used to buy out existing firms (as was more common in the privatization frenzy in Argentina in the 1990s), the foreign investor is investing within the borders of the country. It can be argued therefore that such investment should be subject to the country’s laws.[23] The corporation, its workers, raw materials, energy supply, infrastructure, and any in-state taxes it pays, are sourced in the country in pesos. Local customers pay with (and earn) pesos. Why should foreign investments in Argentina be protected against fluctuations in the relative value of the peso?

More importantly from an economic standpoint, local investment made in local competitors does not have the luxury to recourse to an alternative legal framework like the ICSID. The question, therefore, is why should foreign laws guarantee the investment by means of a BIT and/or ICSID litigation? Does this not result in an unfair advantage to FDI in local industry when compared to domestic investment in that industry? Shouldn’t that nation’s own laws govern FDI and local investment alike to level the playing-field? In the words of economist Dani Rodrik[24]:

“In Turkey, a weak coalition government spent several months during 1999 gathering political support for a bill providing foreign investors the protection of international arbitration. But wouldn’t a better long-run strategy have involved reforming the existing legal regime for the benefit of foreign and domestic investors alike?”

Local Law: The Calvo Doctrine

Whatever the legal arguments are, the presence of alternative jurisdiction is problematic and in the case of Argentina there are efforts to question the legitimacy of ICSID jurisdiction on constitutional grounds.

In a Latin American context there is also the precedent of the Calvo Doctrine that suggests that local jurisdiction is preferable.

Carlos Calvo was an Argentine diplomat, historian, and specialist in international law who was born in Buenos Aires in 1824. His diplomatic career spanned many European capitals representing both his homeland and Paraguay. He is best remembered for his contributions to international law. His work, “The Theoretical and Practical International Law of Europe and America,” came out in 1863. He also compiled fifteen volumes of Latin American treaties, published between 1862 to 1867, so it can be said he was an expert on international treaties. His theories on sovereignty came to be called the “Calvo Doctrine” and have been incorporated into many Latin American constitutions. This doctrine states that people living in a foreign nation should settle claims and complaints by submitting to the jurisdiction of local courts using neither diplomatic pressure nor armed intervention. He justified his doctrine as necessary to prevent the abuse of the jurisdiction of weak nations by more powerful nations. One suspects that Calvo would turn in his grave if he heard of BITs and the ICSID.

Like many of the Washington institutions, the ICSID is facing a nationalist challenge from Latin American countries. There have been calls to coordinate such a challenge among nations in Latin America but the current actions of Bolivia, Venezuela, Nicaragua, and Ecuador to distance themselves from the ICSID and bilaterals are nationalist in origin, thus far, and cannot be seen as a regional movement.

The question is what will Argentina do? Can it resist the multinational onslaught in the ICSID?

Many Latin American governments, at least in rhetorical terms, have been moving away from Washington Consensus economics and have distanced themselves from the IMF and the World Bank. Calls for reform of these multinational institutions (the WTO included) are typically ignored.

The sentiment in Latin America is that national interests have been unduly damaged by the neoliberal experiment that began just a few decades ago. The resurgence of nationalism and regionalism is a global phenomenon and can be partially interpreted as a counterweight to the influence of global multinational corporate power (free-market neoliberalism).

Multilateral legal frameworks can be very positive instruments as evidenced by positive global sentiment for various arms of the United Nations (the WHO for example), the Geneva Conventions on Humanitarian Law, the Kyoto Protocol on Global Warming, and the International Criminal Court. The ICSID has instituted some basic reforms including some elements of transparency but there is much room for improvement. The BITs and the corporate lawyers that interpret them govern litigation in the ICSID. These BITs may need to be adjusted[25] to reflect the experience of their benefits and their problems to date but that is easier said than done. Since adjustments to a BIT typically take 10 years to come into effect, the question is whether Argentina can wait 10 years?

Recent incarnations of economic globalization have not been kind to Argentina and some of its neighbors. They have not yet recovered from the debt crisis that drastically reformed their economies. One could argue that the ICSID should not be used as an instrument to punish them for their recovery.

What is an Investment?

The latest ICSID bond suits facing Argentina are extraordinary because of the jurisdiction chosen in which to reach a decision on the value of the bonds after the default. Normally sovereign debt issues are worked out by meeting the major creditor nations in the “Paris Club.”

A debtor nation, having met some prerequisites, schedules a meeting with the Paris Club to plead their case. The club meets about every six weeks to resolve the latest international debt crisis.[26] Each country has influence over the IFIs and its own financial institutions, and with the help of the IMF the deal is worked out and everyone goes home till the next debt crisis.

New bonds are created by the debtor nation in the jurisdiction of the creditor nations and these replace the bonds in default with a new interest rate, and a new date of expiry and renewed interest payments. Since most of the lender nations are in the Paris Club this small group of country representatives can usually reach a decision that will be acceptable to most.

Bondholders have not in the past had recourse to the ICSID. A vulture fund cannot go to the ICSID to litigate against a country for defaulted debt unless two conditions are met. First, there needs to be an “investment” under the terms of the ICSID Convention. And second, the BIT between the two countries must define “investment” as including a sovereign bond. In the case of Argentina the BIT between Argentina and the United States does not, however the BIT between Argentina and Italy does.

There is precedence within the ICSID of multinational firms creating a presence in a country to take advantage of a BIT with a third country (who receives their claim). Both Bechtel and ENTEL[27] establishing a post office box in Holland to sue Bolivia using the Bolivia-Holland BIT. It is not clear whether such a ploy is being used in the TFA case against Argentina using the Italian BIT. Until a full list of plaintiffs is made public it will remain difficult to distinguish between individual pensioners and vulture funds. Requests to provide such a list by corporate lawyers litigating the case were ignored.

| The ICSID is an unusual forum for commercial and for debt litigation for many reasons: – It is powerful and a call to pay is backed up by the clout of the World Bank. – It is a direct forum for a company to sue a sovereign state for their public funds. – Major public interest issues affected by contracts are rarely aired because it is a closed forum. – Three people make the decision based on prosecuting evidence from a group of corporate lawyers and defending state lawyers (amicus briefs, etc. are rarely admitted). – The decision is irrevocable, i.e. there is no appeals process. – The ICSID assigns the state the role of just another commercial partner.[28] – There is an annulment process that can be invoked after a decision has been reached in the favor of the plaintiff and the defendant wishes to annul the decision. As Marcos Orellana of CIEL explains: “The annulment process looks only at a narrow range of situations that may affect the integrity of the arbitration, and does not address potential errors of law. In CMS v. Argentina, the annulment committee did not overturn the arbitral tribunal’s decision, despite observing that the award contained manifest errors of law.” Again, the lack of appeals is the basic issue, and it goes to the heart of accountability in the exercise of judicial functions. – The ICSID is not designed to protect the rights of the citizens of a state being sued. |

In the words of Yves L. Fortier QC, (a chairman on a board at ICSID):

“Commercial arbitration exists for one purpose only: to serve the commercial man.”[29]

The other reason that the ICSID might be an unusual forum for such claims is that it is designed to resolve investment disputes. A sovereign bond is a sovereign debt instrument, it isn’t an investment in the commercial sense; i.e. it isn’t used to build a factory or to buy a factory. Do bondholders invest in the country whose bonds they buy? Do their investments contribute to the economic function of the state? This has yet to be decided; it depends on the definition of the term “investment.”

If a sovereign bond is bought from a country, this is in effect a loan to the country. The loan could, arguably, be considered to be at least a financial (if not a commercial) investment. However it is difficult to imagine how a vulture fund that buys up distressed bonds on secondary markets with the express purpose of litigation against a state, could be considered to be investing in that state.30

Privatizing Justice

As economists, politicians, diplomats, journalists, human rights experts, and ecologists debate the relative effectiveness of one international tribunal mechanism over another, in the end the complexity of the system implies that the last word shall be left to the experts and the lawyers. Susan Leubuscher in her piece entitled: The Privatisation of Justice: International Arbitration and the Redefinition of the State says:

“Multinational Enterprises have effectively employed bilateral investment treaties and commercial arbitration to cripple the ability of developing states to improve their compliance with international human rights and environment norms, stabilize their land tenure regimes in order to regularize domestic capital formation, determine the best use of their natural resources, and set basic public policy, and have used their contract rights to deprive already poor populations throughout the developing world of their customary rights to land, environmental protection, safety from private security forces within their own villages, and access to justice. Given the enormous disparities in assets and power between the parties to those contracts and the important disadvantages developing countries face in the case of dispute, international investment contracts represent bargaining ‘as much in the shadow of power as in the shadow of the law.’ The result is not, therefore, the neutral procedure praised by the supporters of commercial arbitration, but rather a privatization of justice, for the benefit of the few who can afford to pay for it.

” Clearly, public intrusion is indeed required, and urgently,

in order to ‘confront the betrayal of our deepest ideals.'”31

End Notes

- Bosco, David, “The Debt Frenzy; Vulture Funds,” Foreign Policy, July 1, 2007.

- Schapiro, Robert, on “Bloomberg on the Markets”; Schapiro is currently cofounder/chairman of Sonecon, LLC, Economic Advisers/Lobbyists.

- In Spanish: El Centro Internacional de Arreglo de Diferencias Relativas a Inversiones (CIADI).

- Italian Task Force Argentina: http://www.tfargentina.it/; similar U.S. pressure group: http://www.atfa.org/.

- Nestor Kirchner offered the 450,000 Italian bondholders an offer for their US$14Bn In bonds on Jan. 12, 2005; holders of the US$5.5Bn accepted the offer; the others are the hold outs and secondary buyers.

- http://www.mecon.gov.ar/finanzas/download/us_prospectus_and_prospectus_supplement.pdf

- LOS ‘BUITRES’ DE LA DEUDA, Foreign Policy in Spanish, August-September 2007, David L. Bosco,

http://www.fp-es.org/los-buitres-de-la-deuda - “Repo man” is an Alex Cox movie from the 1980s which chronicles the lives of people whose job it is to repossess vehicles whose owners have fallen behind in their payments

- Peruvian Bounty, Argentine Sanctuary: Latin American Encounters with the U. S. Foreign Sovereign

Immunities Act, Latin Lawyer Magazine, vol. 6, issue 5, June 2007, http://www.arbitralwomen.org/files/publication/4210231249364.pdf - Canada, Mexico, and the United States have faced claims under chapter 11 of NAFTA, but these are not ICSID cases persé. Some claims have been handled by ICSID Additional Facility, which is available when either the host or home state is not a party to the ICSID Convention.

- Depending on jurisdiction, European regional courts can be more appropriate for litigating between EU countries.

- See discussions on this topic in the OECD Global Fora on International Investment (GFI) on the OECD Website, http://www.oecd.org/; particularly revealing are the round table discussions, “NATIONAL SECURITY AND ‘STRATEGIC’ INDUSTRIES.”

- This list of pending cases is compiled from the ICSID section of the World Bank Website:

http://icsid.worldbank.org/ICSID/Index.jsp on February 15, 2008 - They are often referred to as WTO+ agreements, as they add rules to trade between two countries which are above and beyond what those countries are bound to as members of the WTO.

- Very often the state is in fact representing the interest of a multinational in its territory but at least the state is still involved.

- It is estimated that Argentine private savings abroad are at about the size of their current national debt. There is no taxation on the interest on these savings.

- Junta Minister of Economy, José Martinéz de Hoz, is from a landed Argentine family that includes the founder of the Argentine agricultural society “La Rural.” The IMF provided their first loans to his ministry during the Junta/Dictatorship government within a week of the military coup d’État. Martinéz de Hoz was brought to justice after the junta fell from power but was pardoned by President Menem who finally completed De Hoz’s plans to privatize almost all Argentine national industry and services. These included the national mail, water, sewage, gas, electricity, telephones, and YPF, the national oil company. These privatizations are the indirect cause of nearly all of the current lawsuits facing Argentina today in the ICSID. The money borrowed by the Argentine state and the private debt made public during the dictatorship is approximately 20% of Argentina’s current public external debt. The corporate law firm Grondona Benites, Arntsen, & Jose Martinez de Hoz, (Jr.) (Buenos Aires) are among the legal partners prosecuting Argentina in the ICSID in the US$4,400 Million case representing Task Force Argentina: Italian Holders of Argentine Sovereign Tango v. Argentina Republic, ICSID, n° ARB/07/5, http://www.practicallaw.com/1-101-1605

- See p 21, Volume 1, Ministry of Economics Memoir: “Memoria 29-3-1976 – 29-3-1981. “

- In fact the privatization of the national social security pension scheme was responsible for even more debt accumulation. See “Till Debt Do Us Part: Lessons from Argentina’s Experience with the IMF, Debt, and Financial Crises,” Alan Cibils, Americas Program, Center for International Policy, Special Report, September 6, 2006, at https://web.archive.org/web/20080513191152/http://americas.irc-online.org/am/3489

- For an excellent introduction to the ICSID, its shortfalls, and alternatives to resolving investment litigation, please see the excellent report entitled “Challenging Corporate Investment Rules” (2007) by U.S. NGOs: Food and Water Watch and the Institute for Policy Studies, at www.ips-dc.org/reports/070430-challengingcorporateinvestorrule.pdf

- The fact that there are many bondholders in many jurisdictions leads to the need to coordinate an offer which does argue for common jurisdiction and coordination. The question is not that coordination is bad, but simply what form of coordination is appropriate and fair.

- The practice of litigating for someone else’s debt has been recognized as problematic for centuries and has lead to laws against such “Champertous” behavior.

- Note that the country may have multilateral agreements with other states, such as Argentina’s membership in MERCOSUR, which can influence jurisdiction, but even within this context it cedes very little sovereignty on key matters and when it does it does only to its neighbors, so it can be argued, the reciprocity of such an arrangement is likely to be greater than might be the case with say a BIT with the United States or Spain.

- www.foreignpolicy.com/Ning/archive/archive/123/tradinginillusions.pdf

- For some modern thoughts on adjustment see: http://www.iisd.org/

- For the standard treatment of debt see the following:

http://www.clubdeparis.org/sections/termes-de-traitement/termes-de-traitements - For more details on the recent ENTEL case see: http://www.corporateeurope.org/bolivia-eti.html#note11

- For more information see: Leubuscher,S., “The Privatisation of Justice: International Arbitration and the Redefinition of the State,” June 2003, http://www.fern.org/pubs/reports/dispute%20resolution%20essay.pdf.

- Fortier, Y., “New Trends in Governing Law: The New, New Lex Mercatoria, or, Back to the F u ture, ” ICSID Review, 2001, p.10-19, http://www.corporateeurope.org/bolivia-eti.html#note11.

- In this case via the ICSID.

- For more information see: Leubuscher,S., “The Privatisation of Justice: International Arbitration and the Redefinition of the State,” June 2003, http://www.fern.org/pubs/reports/dispute%20resolution%20essay.pdf

Une déclaration transatlantique des droits des multinationales

Non au Traité Transatlantique Une déclaration transatlantique des droits des multinationales

Non au Traité Transatlantique– Une déclaration transatlantique des droits des entreprises

Non au Traité TransatlantiqueIntroduktion till TTIP Fakta om TTIP

Une déclaration transatlantique des droits des multinationales « GLOBAL RELAY NETWORK

Leave a Reply