The Irish Times “Opinion” section has spoken. It welcomes the IMF to Ireland. Maybe the Irish Times should ask Latin America why they decided to pay back all of their debt to the IMF so as to kick their consultants out of their national Ministries of Economics, and then again, maybe not. The IMF is a fait acompli for now, I beg a moment of your time to point out a true flaw in the Times analysis.

To do that it is necessary to focus on the problem (foreign bond exposure) behind the problem (the banking crisis) behind the problem (speculative investments)?

Donal Donovan writes that a “Firm hand of the IMF will keep [Ireland] steering in right direction” His analysis is that:

“While psychologically [the Irish taxpayers] may feel put upon, the arrival of the International Monetary Fund is really not all that bad”

Is that so Mr. Donovan?

As an Irishman living in Buenos Aires I would rather avoid the topic of psychology, and that of the IMF too, for that matter. Psychologically speaking feeling “put upon” is the least of the Irish taxpayer’s problems. Ireland’s financial woes will not be cured on the couch of the IMF. Rather than quote a flawed analysis, I would prefer to highlight the real problem causing the Irish crisis. The problem is the banking sector, it is not the deficit, these problems will not be solved by austerity measures, neither are the banking sectors woes fixed by NAMA. In fact the problems are made worse and transferred to the Irish taxpayer.

The original “mistake” was that Irish Banks make loans for bad speculation. When their client’s investments went bad, this risked a collapse the Irish banks. If the banks do, in fact, collapse, the risk falls on the shoulders of powerful financial interests abroad. It is they that face a real problem. They would be left holding the problem behind the problem behind the problem. But the Irish government gave them a get out of jail free card, NAMA. They love NAMA, for them it is the solution. For the Irish taxpayer it is not.

Mr. Donovan says: “Incidentally, whether the [IMF] money is “for the banks” or “for the State” is a red herring. It will all be signed for by the Irish Government, which owns most of the banks anyway.”

Euro 81Bn.[1] is a very big red herring, in fact what smells “off” about this has nothing to do fish. The problem is, in fact, this very 81Bn of public NAMA exposure; two problems really: 1. it isn’t enough money and 2. it isn’t (or shouldn’t be) public debt.

Donovan is simply parroting the commonly agreed fallacy that Ireland’s two big private banks and their clients should be completely rescued by the Irish taxpayer. The implication is that it is the government’s job to fix the problem of the private financial center, absorbing all of the pain that it can (onto its public tax base).

Why not stick the rest of the bank’s problems in NAMA too? In for a penny in for a pound… Or is it in this case “In for a euro, in for a cent?”

So who would be rescued exactly by such Irish taxpayer generosity? Not the AIB & BOI shareholders. They are now pretty much wiped out. I should know my family owned class A shares in these banks, their values dropped from about $94 US Dollars to about $2 (see for yourself). Long term shareholders hardly care now if the banks are nationalised though this may not be true of the bank’s management. It is the bondholders behind the soon-to-default debt on the books of AIB & BOI who are sweating. Indeed it is probably them that are feeding this misinformation to the Irish Times.

The crux of the governance “mistake” is making the Irish people accept that their government is “responsible” to save the foreign bondholders who stand to lose a lot more than 81Bn. euros if the Irish banks default.

The Irish state is not responsible! For the Irish state to save the banks, if indeed this is either necessary or possible, is to commit financial suicide.

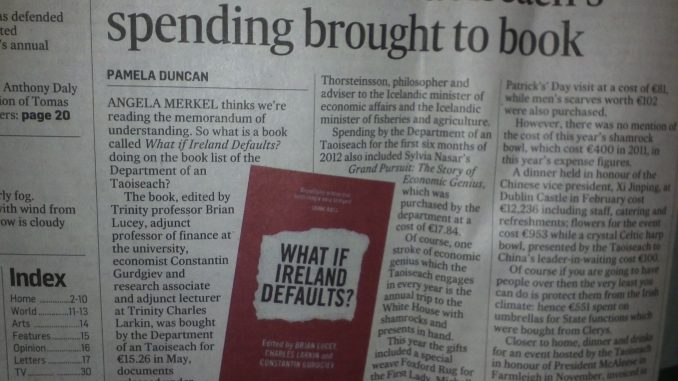

Why not take a leaf out of the Icelandic book on this? The bondholders are not Irish and hence should not be rescued by the Irish government. NAMA should never have existed. The Irish government should have stuck to guaranteeing what governments do; bank deposits up to 100K or 200K, i.e. personal savings and nothing more.

Instead Ireland played nice to their bondholders, they invented the National Asset Management Agency (NAMA), the planet’s most fiscally conservative “bad bank”. A “system” that prompted Nobel Prize-winning economist Joseph Stiglitz to remark that the Irish government was squandering state money to rescue banks.

Why would the government do that to their own people? Who were they protecting? Could this be why the IMF are forcing their attentions on Ireland and why British bankers are coming to Dublin? ?Our engagement in this is because we are good neighbors of Ireland and not because we have particular concerns about any particular U.K. bank,? says George Osborne, the British chancellor of the Exchequer in the New York Times but can we really believe him? Why is it exactly, in a time when credit is extremely hard to find, that suddenly everyone is insisting on lending to the Irish government to give the Irish government money to rescue their banking sector? Could it be that by doing so they rescue their own nation’s private banking sector who have outstanding loans to Ireland? Of course they are happy to make the loan! They stand to lose a fortune if the Irish banks default. Their loans transfer the risk to the Irish taxpayer 🙂

IT boils down to the question as to whether Ireland is really willing to make this crucial mistake; one that may result in decades of austerity for its people? Look at what happened here in Argentina, it has taken a decade to recover from a debt crisis and much less of it is as a result of corrupt loaning practices.

But we have to save the Euro? Right? Right!

If the British bankers are coming to Dublin to patch things up this has very little to do with the stability of the euro. Watch this FT video if you don’t believe me. I warn you it is both doctrinal and bleak (but watch the bankers squirm when they are asked direct questions.)

There is one solution for Ireland’s woes and it is a just solution, this is to roll back NAMA, not add to it, as was the Lex FT column on “Irish banks” suggested today. The international financial sector and the corrupt borrowers love NAMA! They can’t get enough of it. NAMA is the best (read worst if you pay Irish taxes) “bad bank” plan ever invented.

Allowing loans or banks to default is the haircut needed to smarten up in the Irish financial sector! It is a smart alternative to forcing the Irish population to don NAMA hairshirts to rescue speculators with their assets hidden abroad in complex trusts.

A similar “rescue” happened in Greece; same solution different problem. Greece had a chronic deficit problem which lead to chronic debt-to-GDP ratios. Ireland didn’t until NAMA. Since then Ireland’s public debt to GDP ratio has almost tripled. Yet the fix is the same, governments of exposed nations like France or Germany (or in the case of Ireland, Britain) pledge bailout monies to a fund to loan to the Greek (now Irish) taxpayer to avoid default to the lender’s private banks. Hey presto, they rescued (their own) private financial sector using public tax money but indirectly transferring the burden to Greek/Irish taxpayers.

In fact they didn’t fix anything, they simply postponed Greece’s (and if it goes through Ireland’s) problems to calm the financial markets are calmed for a while. The problem, in the press at least, is “solved!”

Might it be that it is the city of London, Frankfurt and New York that is really driving this rescue? Why else are British bankers in Dublin? If you (like British bans) had a $22,000,000,000 Irish exposure problem to solve, maybe you too might might buy a few first class tickets London to Dublin. However it is a bit of a stretch to expense the tickets to “save the euro.”

[1]: NAMA’s initial size

The FT.com disagrees, they want more NAMA and they quote the European commission as saying:

Hey (us too!!!!)

The European Commission and others said the steps the Irish government had taken were “courageous, correct and bold” but that the country needed to “intensify the existing approach,” he said.

Irish fin min to recommend bail-out

By John Murray Brown and Tony Barber in Dublin

Published: November 19 2010 15:06 | Last updated: November 20 2010 22:05

http://www.ft.com/cms/s/0/33e6ebcc-f3e9-11df-901e-00144feab49a.html

“?The banks have been operating with massive support from the European Central Bank and they will continue to operate on that basis but because of the degree of maintenance and support from the ECB, it is essential that we deepen the approach to addressing the structural problems in the bank.”

Cohen

http://www.irishtimes.com/newspaper/breaking/2010/1121/breaking1.html?via=mr